Send Email

canadiansc@live.caToll Free Number

9820115187Send Email

canadiansc@live.caToll Free Number

9820115187

Many students dream of studying abroad but before turning it into reality you need to be aware of the total cost to study in Canada.

Canada as a study abroad destination is undoubtedly an attractive option as getting a high-quality education and earning a globally recognized degree is an exciting opportunity. Especially for students from Nepal, Canada stands out as an excellent study option for various reasons like less tuition fee, state-of-the-art research facilities and a strong focus on practical learning experiences. It also has a diverse culture and a welcoming environment for international students.

The cost of living in Canada for international students is generally less expensive when compared to other Anglophone countries like the UK, USA, and Australia. But it is important to carefully consider all the associated costs and unseen expenses.

The average total cost to study in Canada from Nepal is CAD 35,000. This includes tuition fees, living expenses, and miscellaneous expenses.

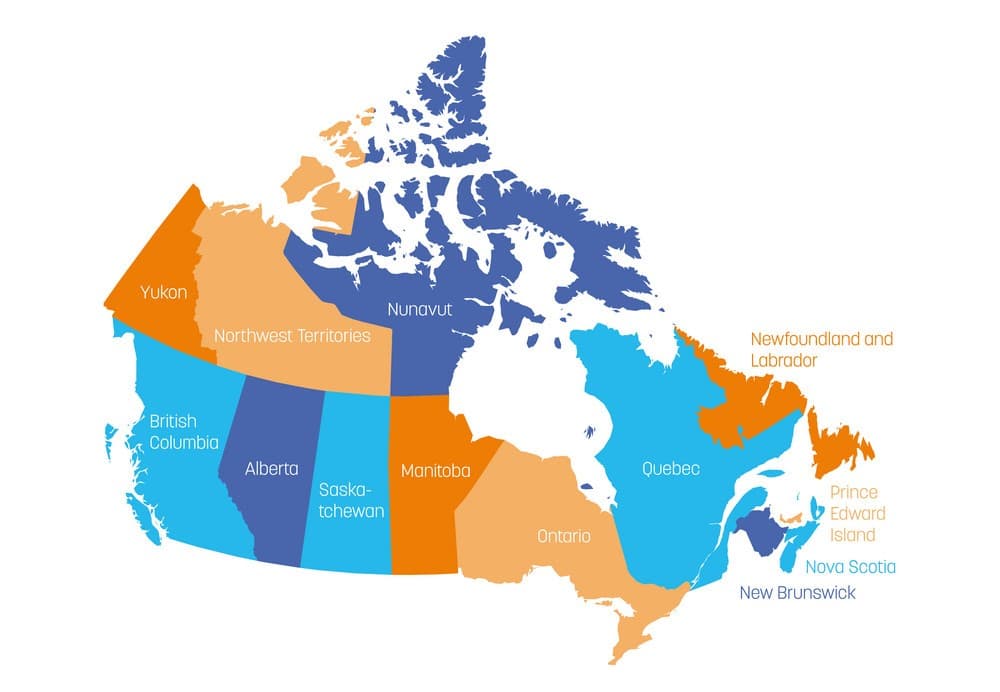

The cost varies across provinces and cities in Canada, fluctuating based on the tuition fees charged by universities. Here is a breakdown of the total cost to study in Canada for international students.

The tuition fees for international students in Canada can range from approximately CAD 15,000 to CAD 35,000 (NPR 14,00,000 to NPR 35,00,000) per year for undergraduate programs and CAD 17,000 to CAD 50,000 (NPR 16,00,000 to NPR 47,00,000) for graduate programs.

These fees can vary significantly based on the field of study and the institution’s reputation. Tuition fees make up the biggest part of the total cost of studying in Canada. This tuition fee also varies based on the program, University, location, and more.

Usually, the courses related to the medical and engineering fields are more expensive in comparison to humanities or environmental sciences. Similarly, the undergraduate programs seem more expensive than the graduate and diploma programs because of the duration of the course and the cost per year.

Overall, international students pay higher tuition fees than Canadian students. In 2022/2023, international undergraduate students paid 429% more than Canadian students, while international graduate students paid 184% more. Graduate students in Nova Scotia, British Columbia, and Ontario face the highest tuition fees.

| Average Tuition Fee Cost In Canada By Provinces | ||

| Provinces | Graduate Tuition Fees (CAD per year) | Undergraduate Tuition Fees(CAD per year) |

| Newfoundland and Labrador | $17,477 | $4,806 |

| Prince Edward Island | $11,502 | $19,750 |

| Nova Scotia | $22,768 | $25,521 |

| New Brunswick | $13,654 | $17,800 |

| Quebec | $20,034 | $31,887 |

| Ontario | $28,152 | $46,433 |

| Manitoba | $12,748 | $18,912 |

| Saskatchewan | $8,965 | $27,781 |

| Alberta | $18,018 | $31,549 |

| British Columbia | $23,441 | $35,266 |

Source: Statistics Canada

| Average Tuition Fee Cost In Canada By Program | |

| Program | Undergraduate Tuition Fees (per year) |

| Dentistry | $23,963 |

| Medicine | $15,182 |

| Veterinary medicine | $14,838 |

| Law | $13,222 |

| Pharmacy | $12,291 |

| Optometry | $10,389 |

| Engineering | $8,527 |

| Business, management, and public administration | $7,207 |

| Mathematics, computer and information sciences | $7,012 |

Living expenses takes up another major part of the total cost to study in Canada for Nepali students. This can vary depending on the city where the University is located and lifestyle choices of the student.

On average, living expenses in Canada for a single student can range from CAD 8,000 to CAD 12,000 (NPR 7,50,000 to NPR 11,80,000) per year.

This includes accommodation, food, transportation, and other miscellaneous expenses.

Accommodation is typically the most substantial expense for Nepali students studying in Canada. Students can choose two types of housing: On-campus or Off-campus.

On-campus housing in dormitories or residence halls can cost around CAD 5,000 to CAD 10,000 (NPR 5,00,000 to 10,00,000) per academic year.

Similarly, off-campus housing like renting an apartment or sharing a flat with roommates can range between CAD 500 to CAD 1200 per month, depending on the city and proximity to the campus.

Whether you want to live on-campus or off-campus is your choice but most of the international students in Canada live on-campus in their first year. They share their rooms, laundry room, kitchen, and social area with other college mates.

Food and groceries also constitute a huge portion of living expenses for international students in Canada. This cost also varies depending on the cooking habits, lifestyle, and the city where the students live. The prices of groceries can vary across different cities and provinces.

Generally, students can expect to spend around CAD 300 to CAD 500 (NPR 29,500 to NPR 49,500) per month on groceries.

Common grocery items and their approximate costs

For students who don’t cook much, or want to experience Canada’s diverse culinary scene, dining out can be expensive. The cost of dining out can vary greatly depending on the type of restaurant, location, and portion sizes.

Common dining-out options and their approximate costs:

In the Canadian cities that are most popular among international students, transportation typically ranges from 80 to 120 CAD per month, constituting around 8% of the overall cost of living for Nepalese students.

Public transportation expenses in Canada are generally considered expensive, especially outside major metropolitan cities like Vancouver. Due to these high costs, many students studying in Canada choose to purchase their vehicles, finding it to be a more economical choice in the long term.

Additionally, flight tickets to and from one’s home country should be factored into transportation expenses.

Apart from the tuition, food, accommodation, and transportation, there are many other unseen costs to study in Canada that students may forget to calculate. Some of them are:

As a foreign student, phone bills and data expenses also matter. The average cost for a phone plan is approximately CAD 20 per month.

Textbooks can be expensive, especially for engineering, law, medicine, and pharmacy courses.

Daily expenses include laundry, toiletries, clothing, dining out, etc. Costs depend on the chosen lifestyle.

According to the financial requirements for study permit applicants updated by the Canadian government as of January 1, 2024, a student coming to Canada should have at least $10,000 per year apart from the tuition. A student must show this financial proof before applying for a study permit in Canada. So, don’t forget to consider this also when you think of the total cost to study in Canada.

This adjustment will affect fresh study permit applications received from January 1, 2024 onwards. The revised amounts align with current cost-of-living standards, which are updated to the low-income cut-off by Statistics Canada annually.

For all provinces except Quebec

| Persons coming to Canada | Amount of funds required per year (not including tuition) |

| You (the student) | CAD 10,000 |

| First family member | CAD 4,000 |

| Every additional accompanying family member | CAD 3,000 |

| Number of family members (including the applicant) | Amount of funds required per year (excluding tuition) |

| 1 | CAD 20,635 |

| 2 | CAD 25,690 |

| 3 | CAD 31,583 |

| 4 | CAD 38,346 |

| 5 | CAD 43,492 |

| 6 | CAD 49,051 |

| 7 | CAD 54,611 |

| If more than 7 people, each additional family member | CAD 5,559 |

Quebec:

To study in Quebec, applicants must prove they meet the financial requirements outlined by the ministère de l’Immigration, de la Francisation et de l’Intégration.

Here is a comparison chart for the total cost to study in Canada with the other most popular English-speaking countries Nepalese students choose to study abroad.

| Country | Canada(in CAD) | USA(in CAD) | UK(in CAD) | Australia(in CAD) |

| Tuition Fee | 15,990 to 21,342 | 43,362 to 81,305 | 19,500 to 54,876 | 13,632 to 48,417 |

| Accommodation Cost | 474 to 677 | 2,032 to 4,200 | 1,540 to 2,395 | 813 |

| Living Expenses | 15,990 to 21,342 | 13,550 to 24,391 | 2,326 | 19,364 to 26,137 |

| Transportation | 40 to 108 | 122 to 176 | 240 | 203 |

| Textbook and Supplies | 2,032 | 1,680 | 205 to 410 | 488 to 1,464 |

Being an international student from Nepal, managing a budget is important when planning about the total cost to study in Canada.

Here are some tips that Nepalese students can implement to successfully manage their finances while studying in Canada.

Before you get worried about handling all the finances to cover the total cost to study in Canada, here is some good news. International students studying in Canada have a potential for scholarships and bursaries targeted especially for you.

They usually range from $500 to $10,000, but receiving them can be a tough competition. Still, even if you get a small amount, it can help ease your financial worries.

To get scholarships, you usually need to have good grades, but they also look at other things like how involved you are in your community, if you’ve shown leadership skills, done volunteer work, or if you’ve done any research.

You’ll need to apply for scholarships from your university, as well as from other organizations like government agencies and private groups.

Bursary is a financial award given to students to assist with the total cost of education or training in Canada.

They are typically awarded based on financial need or other criteria such as academic achievement, extracurricular involvement, or specific talents or interests.

Bursaries are often provided by educational institutions, governments, charitable organizations, or private donors to help make education more accessible to individuals who may not otherwise be able to afford it.

Students who arrived in Canada through the Canadian Study Center received bursary awards in 2023 supported by Canadian Study Center Inc, Mississauga Office. It was awarded based on financial need, academic achievement, and financial hardship in Canada.

Bursaries play a vital role in making education more accessible and affordable for students across Canada, particularly for those who may face financial barriers to accessing higher education.

Although you cannot cover the total cost to study in Canada by doing a part-time job, you can earn some pocket money for yourself by doing some part-time job while gaining professional skills.

International students studying in Canada are permitted to work for up to 20 hours per week during regular classes, and they can work full-time during term breaks or vacations.

To find part-time employment opportunities, students can search for job listings online or check the university’s notice boards for vacancies. This allows students the flexibility to manage their work schedules alongside their academic commitments and can help them gain valuable work experience while studying.

Popular on-campus jobs can be working in the Cafeteria, Library, Research lab, Teaching department, Administrative office, Student organizations, Campus guide for newcomers and visitors, and so on.

Similarly, popular off-campus jobs can include positions such as Sales assistant, Dog walker, Delivery driver, Barista, Accounting clerk, Graphic designer, etc.

Many programs in Canada like computer science, engineering, architecture, and others, integrate practical work experience, known as co-op placements, into their curriculum. These placements can involve work either on or off campus, depending on the nature of the program.

This typically lasts for 3 to 4 months or longer each year, co-op placements provide students with hands-on experience in their field of study. However, getting such placements requires obtaining a co-op work permit, for which specific eligibility must be met.

The total cost of studying in Canada can seem overwhelming at first sight but you should take it as an investment.

Investing in a global education experience opens opportunities for personal and professional growth. It provides you with valuable skills, knowledge, and networks that can significantly enhance your future career prospects.

For many ambitious Nepalese students, the opportunity of getting access to an advanced economy like Canada and the long-term career benefits that come with it outweigh the associated costs of studying abroad.

Canada’s dynamic academic and professional environment provides exposure to cutting-edge research, innovative industries, and diverse cultural perspectives, laying a solid foundation for future success.

So, despite the cost, the potential rewards of studying in Canada make the investment worth it.

The cost of studying in Canada typically falls between CAD 15,000 and CAD 35,000 annually for undergraduate programs. The amount is equivalent to NPR 14,78,908 to NPR 34,50,786.

Studying a 1-year diploma course in Canada can cost you around 10,000 – 15,000 CAD. Apart from the tuition fee, the other expenses like accommodation, transportation, food, and lifestyle can cost you somewhere between 10,000 CAD to 15,000 CAD.

The Canada visa fee for the study permit (including extensions) per person is 150 CAD. Furthermore, you can restore your study visa status for 229 CAD and get a new study permit for 150 CAD.

According to the IRCC financial requirement update from January 2024, the minimum amount of funds required per year (excluding tuition) is CAD 20,635.

The minimum bank balance for Canada student visa as of January 2024 is CAD 20,635 per year, apart from the first year’s tuition fee.

Your relatives who are 18 years old or older and meet specific citizenship or residency criteria in Canada can sponsor you. This includes Canadian citizens, individuals registered under the Canadian Indian Act, or permanent residents of Canada.

Generally, sponsors must reside in Canada to sponsor eligible relatives, with exceptions for Canadian citizens living abroad who intend to return to Canada upon their relatives’ immigration and are sponsoring their spouse, common-law or conjugal partner, or dependent children without dependent children of their own.

There are no limitations on the funds you can bring into or take out of Canada, and it’s perfectly legal to do so as long as you declare it.

Whether you’re departing from or arriving in Canada, it’s mandatory to declare any currency or monetary instruments totaling CAD 10,000 or more that you’re carrying.

This encompasses Canadian or foreign currency, as well as a combination of both. Monetary instruments encompass various items such as stocks, bonds, bank drafts, cheques, and traveler’s cheques.

Leave a Comment